ganhomilionario1.online

Market

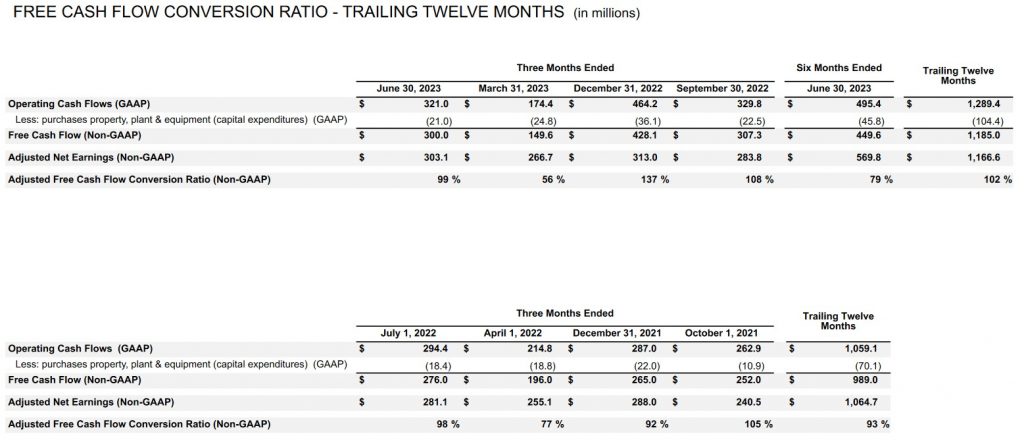

Fcf Conversion

free cash flow conversion means, where Adjusted EBITDA is positive, an amount equal to free cash flow divided by Adjusted EBITDA. Sample. Free cash flow (FCF) margin is a liquidity metric that measures how efficiently a company's profitability can convert its revenue into free cash flow. Free cash flow (FCF) represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base. FCF (First Commonwealth Financial) Cash Conversion Cycle as of today (August 18, ) is. Cash Conversion Cycle explanation, calculation, historical data. FCF is a non-profit which connects funders with forest conservation projects This leads to illegal logging, poaching, and even conversion to farming. Principles Of Compounding With Bonds & Stocks · How ROCE & Free Cash Flow (FCF) Conversion Are Linked. The Cash Conversion Ratio (CCR) is a financial management tool used to determine the ratio between the cash flows of a company to its net profit. FCF Conversion = (free cash flow / net earnings) When there is a huge difference between the free cash flow and the earnings of a company, you. FCF Conversion = (free cash flow / net earnings) Seek for companies with a FCF conversion of at least 85%. 6️⃣ Free cash flow yield The free cash. free cash flow conversion means, where Adjusted EBITDA is positive, an amount equal to free cash flow divided by Adjusted EBITDA. Sample. Free cash flow (FCF) margin is a liquidity metric that measures how efficiently a company's profitability can convert its revenue into free cash flow. Free cash flow (FCF) represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base. FCF (First Commonwealth Financial) Cash Conversion Cycle as of today (August 18, ) is. Cash Conversion Cycle explanation, calculation, historical data. FCF is a non-profit which connects funders with forest conservation projects This leads to illegal logging, poaching, and even conversion to farming. Principles Of Compounding With Bonds & Stocks · How ROCE & Free Cash Flow (FCF) Conversion Are Linked. The Cash Conversion Ratio (CCR) is a financial management tool used to determine the ratio between the cash flows of a company to its net profit. FCF Conversion = (free cash flow / net earnings) When there is a huge difference between the free cash flow and the earnings of a company, you. FCF Conversion = (free cash flow / net earnings) Seek for companies with a FCF conversion of at least 85%. 6️⃣ Free cash flow yield The free cash.

5️⃣ FCF Conversion The more earnings are translated into. FCF, the better. FCF Conversion = (free cash flow / net earnings) Seek for companies. FCFs. The FCF (Flux Conversion Factor), is the value needed to convert data from pW to Jy. The FCF is calculated by observing one of our 'calibrators'. Free Cash Flow and Adjusted Free Cash Flow Conversion Ratio: Year Ended. December 31, Net Cash Provided by Operating Activities. 9, $. Purchases of. free cash flow margin. This metric measures how much of a company's revenue is converted into free cash flow. It's an indicator of the efficiency with which. FCF Conversion: How much of a company's EBITDA gets “converted” into its Free Cash Flow? • Higher percentages are generally more positive, if they are. Tracking the CCC metric enables your company to recognize and address any operational inefficiencies or pinch points which may impede free cash flow (FCF) and. FCF conversion ~%; FCF yield for acquisitions > (WACC + risk premium) by Free cash flow conversion of % or more and a strong balance sheet. In most cases, FCF will be around % of adjusted net income. This means that a company's adjusted net income is a good approximation of the. (4) FCF Conversion is calculated as the ratio between the free cash flow to Solvay shareholders (before netting of dividends paid to non-controlling. The FCF Formula = Cash from Operations - Capital Expenditures. FCF represents the amount of cash flow generated by a business after deducting CapEx. “Free cash flow conversion” means adjusted EBITDA less capital expenditures, divided by adjusted EBITDA. Free cash flow is defined as funds independent of capital expenditures. The cash conversion cycle is a value that expresses the efficiency a company has at. FCF conversion. Get Email Updates. FCF conversion. by Umang Santuka. 14 results found: Showing page 1 of 1. Industry. Export. Edit Columns · ganhomilionario1.online FCFs. The FCF (Flux Conversion Factor), is the value needed to convert data from pW to Jy. The FCF is calculated by observing one of our 'calibrators'. Principles Of Compounding With Bonds & Stocks · How ROCE & Free Cash Flow (FCF) Conversion Are Linked. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Conversion · Growth Appreciation Period · Income Tax Distortion · Invested Capital Free Cash Flow And FCF Yield. Metrics are only as good as the data that. Free cash flow (FCF) of $ million, generating 97% Adjusted FCF conversion. VIEW FULL RELEASE >. DOWNLOAD. EARNINGS CALL WEBCAST · EARNINGS RELEASE(HTML). FCF-Conversion. A, B, C, D, E, F, G, H, I, J, K, L, M. 1. 2, Historical. 3, FL - Free Cash Flow Conversion Analysis: Year 1, Year 2, Year 3, Year 4. Cash flow conversion is a liquidity ratio that measures the company's ability to convert net profit into free cash flow. In other words, it.

Gold Coins That Are Worth Money

:max_bytes(150000):strip_icc()/US1000-1839-8-Proof-Liberty-Head-10-Gold-Eagle-Large-Letters-5ab1a821303713003768fd37.jpg)

This US gold coin price guide gives both buyers and sellers a deeper understanding of the factors that affect the value of gold coins. The Ultimate List of Valuable Coins ; Morgan Silver Dollar · Morgan Silver Dollar · $k ; Steel Wheat Penny · Steel Wheat Penny · $k ; Morgan. S Indian Princess Head Gold $3 ($6,,). The S Indian Princess Head Gold $3 coin presents an intriguing mystery that only adds to its value. Generally speaking, you can calculate the real value of a gold bullion coin by multiplying the pure gold content by the current gold spot price. Double Eagle And here is the world's most expensive coin of all time: the Double Eagle, worth up to $ million. It sold for this price at auction. List of most expensive coins ; $6,,, , Flowing Hair dollar ; $6,,, , Umayyad Gold Dinar ; $5,,, , Brasher Doubloon - EB on Wing. The Double Eagle is currently the rarest and most valuable coin in the world, with an estimated value of around $20 million. What makes a coin so valuable? Top rarest gold coins in the world | Price, value, worth, most expensive. The D gold dollars were minted during the American Civil War when Confederate. USA Coin Book has compiled a list of the most valuable US Gold coins using a database of over + coins and valuations. These are the most valuable gold. This US gold coin price guide gives both buyers and sellers a deeper understanding of the factors that affect the value of gold coins. The Ultimate List of Valuable Coins ; Morgan Silver Dollar · Morgan Silver Dollar · $k ; Steel Wheat Penny · Steel Wheat Penny · $k ; Morgan. S Indian Princess Head Gold $3 ($6,,). The S Indian Princess Head Gold $3 coin presents an intriguing mystery that only adds to its value. Generally speaking, you can calculate the real value of a gold bullion coin by multiplying the pure gold content by the current gold spot price. Double Eagle And here is the world's most expensive coin of all time: the Double Eagle, worth up to $ million. It sold for this price at auction. List of most expensive coins ; $6,,, , Flowing Hair dollar ; $6,,, , Umayyad Gold Dinar ; $5,,, , Brasher Doubloon - EB on Wing. The Double Eagle is currently the rarest and most valuable coin in the world, with an estimated value of around $20 million. What makes a coin so valuable? Top rarest gold coins in the world | Price, value, worth, most expensive. The D gold dollars were minted during the American Civil War when Confederate. USA Coin Book has compiled a list of the most valuable US Gold coins using a database of over + coins and valuations. These are the most valuable gold.

Gold coins will vary in value depending on how rare they are, when they were minted, in what condition they're in, the metal content, the standard of. All of the US gold coins minted from the s right into the s and s are generally worth multiples more than bullion value. What are the most valuable coins in circulation? · S Lincoln Cent With a Doubled Die Obverse, $54, · D Wisconsin State Quarter with an Extra Leaf. The price of a gold bullion coin is most often influenced by the coin's weight and the current market price of gold. Condition is a minor factor. A few. Glimpses of Gold: The Saint-Gaudens Double Eagle. When you think of dollar coins worth money, gold comes to mind, and the Saint-Gaudens Double Eagle is the. Silver Dollar- This amazingly valuable US coin has everything that a collector values. It is rare. There were only of these coins ever produced and. When you think of dollar coins worth money, gold comes to mind, and the Saint-Gaudens Double Eagle is the epitome of this category. Bearing the name of its. 14 of the most valuable coins · doubled die obverse Lincoln Memorial cent · D Wisconsin quarter, Extra Leaf Low variety · Sacagawea Cheerios dollar. The Liberty Head Nickel is one of the most famous and valuable coins in the world. It is a rare five-cent piece which was produced in extremely limited. Circulated examples graded Very Good are worth about $1,, while a rare AU58 can fetch as much as $19, PCGS records show that the most valuable Gold coins will vary in value depending on how rare they are, when they were minted, in what condition they're in, the metal content, the standard of. Old Coins That Are Worth Money · O $3 Gold Indian XFN · O Gold U.S. Dollar AUN · O Gold Quarter Eagle MSN · O $5 Half Eagle with Motto. We thought it would be interesting to take a look at some of the most valuable gold coins from the four US Mints that are no longer in existence. Spot price ; $2, Austrian Gold Philharmonic ; $2, American Gold Eagle Type II ; $2, South African Gold Krugerrand ; $2, Canadian Gold. Coins Worth Money · 1 pound Elizabeth II x2 Different coins, one with and one without errors · Braided Hair Large Cent - better condition antique. The condition of a twenty dollar gold piece coin can make two seemingly similar coins be worth $1,, $12,, or maybe even $, You will need to talk to. A coin's numismatic or collector value may be higher than its melt value. For values of specific dates and grades for NGC-certified US Gold Coins, visit the NGC. Three Dollar Gold Pieces - Front Three Dollar Gold Pieces - Back · Three Dollar Gold Pieces. (Rare dates: D, ; Scarce dates: O, S, Top rarest gold coins in the world | Price, value, worth, most expensive. The D gold dollars were minted during the American Civil War when Confederate.

Mutual Funds With Low Risk

Treasury bills and CDs. They're lower-risk investments and tend to offer better returns than savings accounts, but they are not insured by the FDIC. Balanced fund - Mutual funds that seek both growth and income in a portfolio Blue chip - A high-quality, relatively low-risk investment; the term. Fidelity® US Low Volatility Equity Fund (FULVX) Helps minimize volatility risk in down markets with the potential to benefit in up markets. These types of funds invest primarily in treasury bills and other high quality, low risk short-term investments. Offering stability, minimal risk and. This publication explains the basics of mutual fund investing, how mutual funds investments to assets with less risk, like cash equivalents. On the other. Our low volatility mutual funds invest in BMO Low Volatility ETFs that are designed to provide lower risk than the broad market while providing potential. A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer a low level of risk because. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. Money market funds are low-risk as they invest in stable, short-term debt You can buy bond funds through mutual fund companies or brokerage accounts. Treasury bills and CDs. They're lower-risk investments and tend to offer better returns than savings accounts, but they are not insured by the FDIC. Balanced fund - Mutual funds that seek both growth and income in a portfolio Blue chip - A high-quality, relatively low-risk investment; the term. Fidelity® US Low Volatility Equity Fund (FULVX) Helps minimize volatility risk in down markets with the potential to benefit in up markets. These types of funds invest primarily in treasury bills and other high quality, low risk short-term investments. Offering stability, minimal risk and. This publication explains the basics of mutual fund investing, how mutual funds investments to assets with less risk, like cash equivalents. On the other. Our low volatility mutual funds invest in BMO Low Volatility ETFs that are designed to provide lower risk than the broad market while providing potential. A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer a low level of risk because. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. Money market funds are low-risk as they invest in stable, short-term debt You can buy bond funds through mutual fund companies or brokerage accounts.

Check out the list of Top Performing Low Risk Mutual Funds and good returns to consider to Invest in India in and invest online free at ET Money. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Victory Funds. mutual-funds. piggy bank icon. Your cash could earn %* in a low risk, highly liquid money market investment. *Victory Money Market Fund. Fixed income funds invest in bonds or other fixed income instruments and are understood to typically carry less risk than stocks, or equities; Equity funds. Money market mutual funds. These mutual funds tend to offer very low yields and very low risk compared with bond and equity funds. Instead of appreciation or. Considered one of the lowest risk investments as they commonly invest in short term government securities, tax-exempt municipal securities and corporate and. Mutual funds are subject to various risks, as described fully in each Fund's prospectus. There can be no assurance that the Funds will achieve their investment. Closed-end funds, which are a less common type of investment company, differ from open-end funds because they raise money only once in a single offering, much. Higher risk & higher returns · High Performance · Higher Risk · High Yield · More safe & affordable · Low Risk · Low Expense · Performance vs peers. Money Market Funds. A money market fund is a type of mutual fund that typically has low risks. They work by investing in high-quality, short-term. List of Low Risk Risk Mutual Funds in India ; Invesco India Arbitrage Fund, Hybrid, Low ; Tata Arbitrage Fund, Hybrid, Low ; Bank of India Overnight Fund, Debt. Money Market Funds. Overview. Lowest-risk mutual fund investment. Strive for preservation of capital. A range of taxable and tax-free funds. Investor Profile. Compared to other mutual funds, money market funds have relatively low risks, Money market funds are limited by law to high quality, short-term investments. mutual fund shares. Identify mutual funds matching your investing goals for risk, returns, fees, and minimum investments. Many platforms offer fund. If you are searching low risk then do not go for any small cap mutual fund better to go for mid cap, large cap, flexi cap or index fund. Now if. Money market funds have relatively low risks. By law, they can invest only in certain high-quality, short-term investments issued by U.S. corporations, and. They can include CDs, bonds, Treasury bills and debt-based and cash equivalent securities — all of which are low-risk investments. Because of their availability. Money market mutual funds are not guaranteed or federally insured. Cash: Risk & Return. Cash is considered a low-risk, low return asset. Cash can remain as cash. The best no-load mutual funds ; Fidelity Blue Chip Growth, FBGRX ; Heartland Mid Cap Value, HRMDX ; Mairs & Power Growth, MPGFX ; T. Rowe Price Dividend Growth. Funds. Money market funds are a type of mutual fund that has relatively low risks compared to other mutual funds and ETFs. (and most other investments). By.